Understanding Business Cycles

Learn how business cycles work—from expansion to recession and back. A practical guide to tracking growth, inflation, and the four seasons of the economic cycle.

What You'll Learn

- Understand the phases of a business cycle

- Learn the 4 Seasons framework for classifying cycle phases

- Know which indicators track business cycle position

- Recognize how different assets perform in each phase

The business cycle is the heartbeat of the economy. Understanding where we are in the cycle helps explain why certain assets outperform, why policy changes, and what might come next.

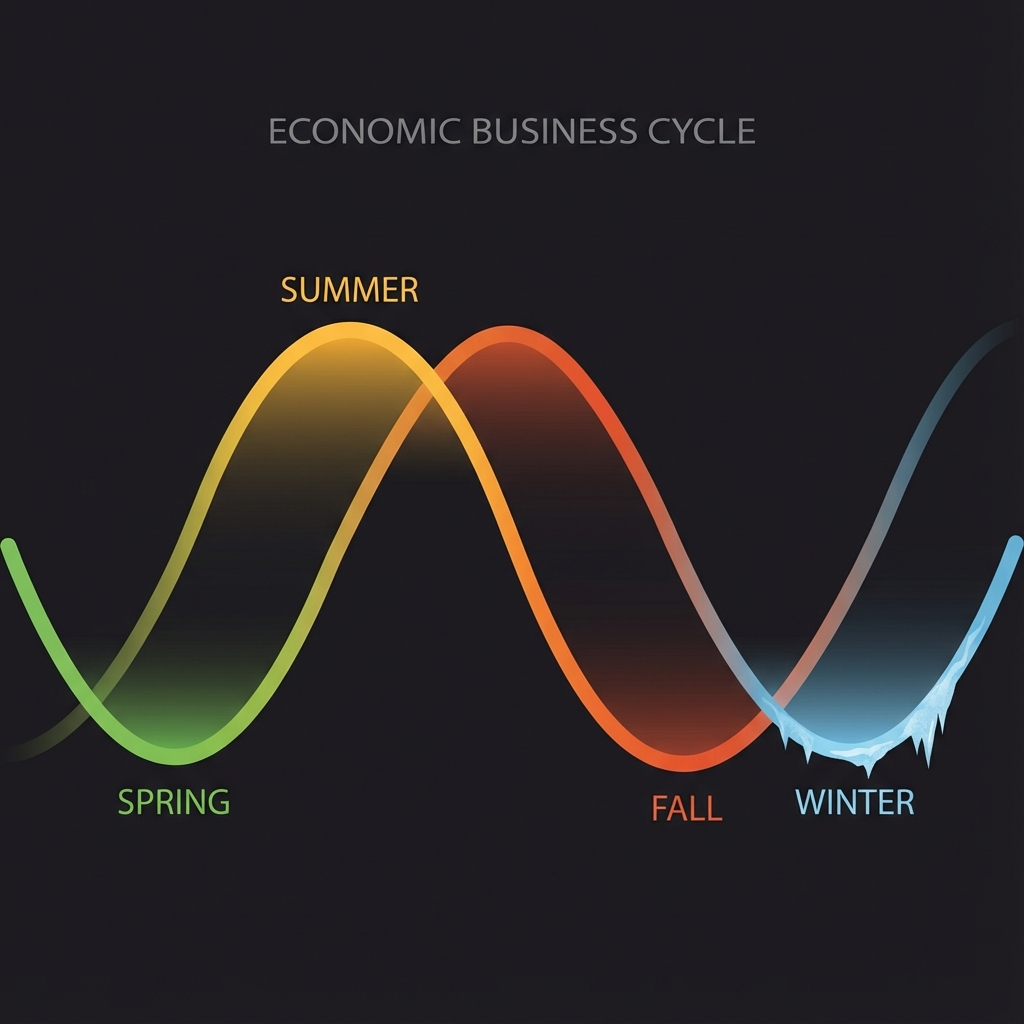

This guide explains how business cycles work, how to track them, and how VantMacro'We use a "4 Seasons" framework to classify these phases. Just as winter reliably follows autumn, economic slowdowns reliably follow booms.

The Four Seasons

What is a Business Cycle?

A business cycle is the recurring pattern of expansion and contraction in economic activity. It's characterized by:

- Expansion: GDP growing, unemployment falling, confidence rising

- Peak: Maximum output before the slowdown begins

- Contraction: Growth slowing or negative, layoffs increasing

- Trough: The bottom—lowest point before recovery begins

- Recovery: Growth resuming, leading back to expansion

Cycles don't run on fixed schedules. Expansions can last 2-10+ years; contractions typically last 6-18 months.

The Four Season Framework

VantMacro uses a "seasonal" metaphor—popularized by macro strategist Julien Bittel (Global Macro Investor / Real Vision)—to classify business cycle phases:

Spring: Early Recovery

Economic profile:

- Growth accelerating from trough

- Inflation low or falling

- Policy accommodative

- Confidence rebuilding

Typical conditions:

- Chicago Fed National Activity Index (CFNAI) rising from negative territory

- Consumer Price Index year-over-year below 2-3%

- Fed funds rate low or being cut

Asset implications (historical):

- Equities tend to rally strongly

- Cyclicals and small caps often outperform

- Credit spreads compress

- Duration underperforms as yields stabilize

Summer: Mid-Cycle Expansion

Economic profile:

- Growth above trend

- Inflation rising but controlled

- Policy neutral to slightly tightening

- Confidence high

Typical conditions:

- CFNAI solidly positive (>0.5)

- CPI YoY 2-4%

- Fed in "data-dependent" mode

Asset implications (historical):

- Equities positive but more selective

- Commodities benefit from strong demand

- Quality/value rotation possible

- Duration neutral

Fall: Late-Cycle Deceleration

Economic profile:

- Growth slowing from peak

- Inflation sticky or elevated

- Policy tightening

- Confidence beginning to waver

Typical conditions:

- CFNAI falling from peak

- CPI YoY above 3-4%

- Fed funds rate rising or high

Asset implications (historical):

- Equity returns compress; volatility rises

- Defensives and quality outperform

- Duration becomes attractive as rate hikes peak

- Gold often performs well

Winter: Recession

Economic profile:

- Growth contracting

- Inflation falling (demand destruction)

- Policy pivoting to emergency mode

- Confidence low

Typical conditions:

- CFNAI deeply negative (<-0.7)

- Yield curve re-steepening

- Fed cutting aggressively

Asset implications (historical):

- Equities decline; cash outperforms

- Duration rallies as rates fall

- Credit spreads widen sharply

- Quality premium highest

Key Indicators: CFNAI

VantMacro primarily uses the Chicago Fed National Activity Index (CFNAI) to track business cycle conditions.

What is CFNAI?

CFNAI is a weighted average of 85 existing monthly indicators of national economic activity. It's constructed so that:

- CFNAI = 0 = Economy growing at historical trend

- CFNAI > 0 = Above-trend growth

- CFNAI < 0 = Below-trend growth

VantMacro Thresholds

| CFNAI Level | Interpretation |

|---|---|

| > +0.5 | Above trend (strong growth) |

| 0 to +0.5 | Near trend (moderate growth) |

| -0.7 to 0 | Below trend (slowing growth) |

| < -0.7 | Recession-like conditions |

Why CFNAI Over GDP?

- Timeliness: CFNAI is released monthly; GDP is quarterly with revisions

- Breadth: 85 indicators vs. one composite number

- Real-time: Less revision-prone than GDP

- Momentum capture: Shows direction, not just level

FRED series: CFNAI (Chicago Fed National Activity Index)

Inflation: The Other Axis

Business cycle seasons depend on both growth and inflation. Two economies with the same growth rate can be in different seasons if inflation differs.

VantMacro Inflation Thresholds

| CPI YoY Level | Classification |

|---|---|

| < 2.0% | Low (disinflationary) |

| 2.0-3.5% | Normal (target zone) |

| 3.5-5.0% | Elevated |

| > 5.0% | High |

Inflation Slope Matters Too

- Rising inflation suggests late-cycle pressures

- Falling inflation suggests demand weakness or successful policy tightening

- Stable inflation is typically mid-cycle

The Season Matrix

VantMacro classifies seasons using a 2x2 matrix (simplified):

| Inflation Low/Falling | Inflation Elevated/Rising | |

|---|---|---|

| Growth Rising | Spring | Summer |

| Growth Falling | Winter (if severe) | Fall |

The actual classification includes more nuance:

- Growth state: Above trend / Near trend / Below trend

- Growth slope: Rising / Stable / Falling

- Inflation state: Low / Normal / Elevated / High

- Inflation slope: Rising / Stable / Falling

How Seasons Relate to Regimes

VantMacro's Business Cycle Seasons and Composite Regimes are complementary frameworks:

| Framework | Focus | Time Frame |

|---|---|---|

| Seasons | Growth + Inflation dynamics | Medium-term (months) |

| Regimes | Growth + Liquidity + Risk | Short-term (days-weeks) |

Mapping (approximate):

| Season | Typical Regimes |

|---|---|

| Spring | Reflationary Expansion, Post-Shock Recovery |

| Summer | Late-Cycle Inflationary Boom |

| Fall | Stagflationary Squeeze, Disinflationary Slowdown |

| Winter | Crisis/Liquidation, Transitional |

Learn more: Market Regimes Explained →

Tracking the Cycle Yourself

Key Data Sources

| Indicator | Source | Frequency | What It Shows |

|---|---|---|---|

| CFNAI | Chicago Fed (FRED) | Monthly | Growth vs. trend |

| ISM Manufacturing PMI | ISM | Monthly | Factory activity |

| ISM Services PMI | ISM | Monthly | Services activity |

| CPI YoY | BLS (FRED) | Monthly | Inflation level |

| Unemployment Rate | BLS (FRED) | Monthly | Labor market slack |

| Yield Curve (10Y-2Y) | FRED | Daily | Recession signal |

Simple Framework

- Check CFNAI: Above or below trend?

- Check CPI YoY: Inflation high or low?

- Check momentum: Are both rising or falling?

- Combine: Which season fits?

VantMacro Dashboard

VantMacro automates this with:

- Real-time season classification

- Growth and inflation gauges

- Historical season comparison

- Integration with regime detection

Common Questions

"How long do cycles last?"

It varies enormously:

- Expansions: 58 months average (post-WWII), but ranged from 12 to 128 months

- Contractions: 11 months average, but ranged from 2 to 18 months

The 2009-2020 expansion lasted 128 months—the longest on record.

"Can we predict recessions?"

Not precisely. Leading indicators (yield curve, credit spreads, CFNAI trend) can signal elevated risk, but timing is unreliable. VantMacro focuses on identifying current conditions, not predicting the future.

"Why use seasons instead of expansion/contraction?"

The four-season framework captures more nuance:

- Expansion can be "spring" (early, disinflationary) or "summer" (mature, inflationary)

- Late cycle isn't recession but isn't healthy expansion either

- It aligns naturally with asset allocation frameworks

"Is CFNAI better than PMI?"

They're complementary:

- CFNAI: Broader (85 indicators), less revision-prone, better for regime classification

- PMI: More timely (first business day of month), forward-looking (new orders)

Practical Takeaways

- Know your season — Spring favors risk; Winter favors safety

- Track Chicago Fed National Activity Index (CFNAI) monthly — It's the best single indicator of cycle position

- Watch inflation direction — Not just level, but whether it's rising or falling

- Combine with liquidity — Seasons tell you about the economy; liquidity tells you about markets

- Don't time the turn — Recognize when conditions have shifted, don't predict when they will

Data Sources

- NBER: US business cycle dating — https://www.nber.org/research/business-cycle-dating

- Chicago Fed: CFNAI overview — https://www.chicagofed.org/publications/cfnai/index

- FRED series: CFNAI — https://fred.stlouisfed.org/series/CFNAI

- FRED series: CPI (

CPIAUCSL) — https://fred.stlouisfed.org/series/CPIAUCSL

Methodology

- Uses a seasonal “growth × inflation” lens (Spring/Summer/Fall/Winter) to describe where the economy is within the cycle.

- Treats CFNAI as a broad, composite growth proxy and CPI YoY as a practical inflation proxy for discussing cycle dynamics.

- Uses NBER recession dates as an ex-post reference point, not as a real-time timing model.

Limitations

- Cycle labels are simplifications; transitions are messy and mixed signals are common.

- CFNAI and inflation data are released with lags and can be revised, so real-time inference differs from backfilled history.

- The framework is descriptive context, not a forecasting guarantee or investment advice.

Further Reading

- Market Regimes Explained — How cycles feed into regime classification

- CFNAI vs PMI — Comparing growth indicators

- The Complete Guide to Global Liquidity — The other half of regime analysis

Track Business Cycles on VantMacro

- Real-time season classification with growth/inflation breakdown

- CFNAI tracking with historical context

- Integration with regime and liquidity analysis