Market Regimes Explained

Understand VantMacro's 7-state regime classification system. Learn how growth, liquidity, and risk combine to define market environments—with empirical backtests across 427+ regime changes.

What You'll Learn

- Understand what market regimes are and why they matter

- Learn VantMacro's 7-state regime classification system

- See how different regimes produce different asset performance

- Know how to interpret the current regime for context

Markets don't move randomly. They cycle through distinct regimes—periods where growth, inflation, liquidity, and risk combine in recognizable patterns.

VantMacro's regime classification system identifies which regime we're in right now, based on real data. This guide explains how it works, what each regime means, and how historical performance has varied across them.

What is a Market Regime?

A market regime is a distinct macro-economic environment characterized by the combination of:

- Growth conditions — Is the economy expanding or contracting?

- Liquidity & policy stance — Are central banks easing, neutral, or tightening?

- Market risk appetite — Are investors risk-seeking or defensive?

Different regimes produce different market dynamics. Understanding the current regime helps you interpret market moves in context.

Why Regimes Matter

From VantMacro's analysis of 427 regime transitions since 2003:

- Asset behavior differs by regime — Especially for equities and some risk assets (with important caveats below)

- Transitions are not random — Some regime changes recur in recognizable patterns, but timing remains uncertain

- Context improves interpretation — Knowing “where we are” helps explain why markets behave the way they do

Important: Regime analysis provides context, not trading signals. Past regime performance doesn't guarantee future results.

Empirical Grounding (What We Measured)

VantMacro’s regime research is grounded in a daily historical replay of the classifier. From this replay we quantify:

- Durations — How long each regime tends to last (contiguous regime periods)

- Transitions — What regimes most often follow what (next-regime probabilities)

- Statistical support — Whether returns differ across regimes for major assets (ANOVA)

- Out-of-sample persistence — Whether in-sample regime patterns hold in a later time window

Headline results (regime history, 2003-12-17 to 2025-12-05):

- 8,025 daily classifications, forming 428 regime periods (i.e., 427 transitions)

- Regimes are short: median durations range from 3 to 31 days depending on the regime

- Regime dependence is mixed by asset: strongest for equities; weaker for long-duration bonds and gold

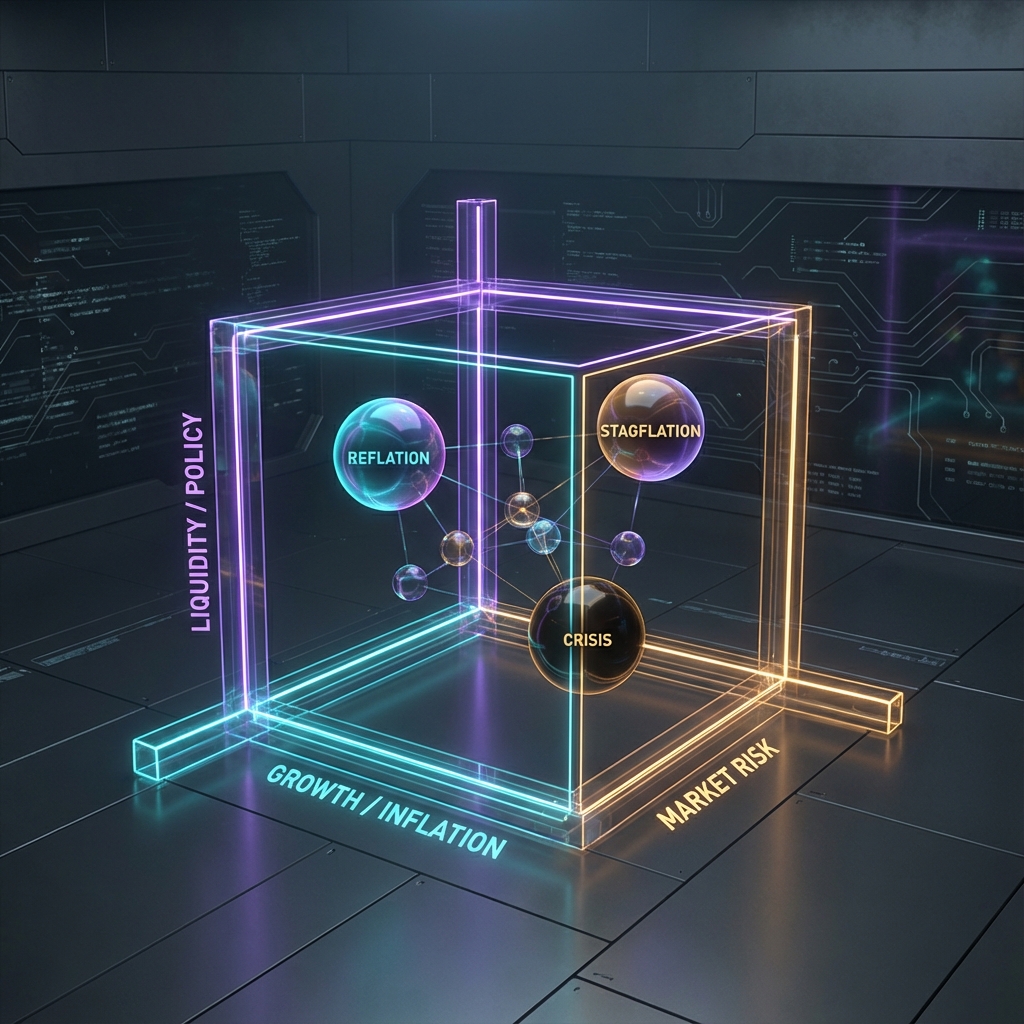

VantMacro's 3-Dimensional Classification

VantMacro classifies market conditions along three independent dimensions, then combines them into a composite regime.

Dimension 1: Real Cycle

What it measures: Growth and inflation dynamics (where are we in the business cycle?)

| State | Characteristics |

|---|---|

| Reflationary/Goldilocks | Growth improving, inflation low or falling |

| Inflationary Boom | Growth strong, inflation rising |

| Stagflationary Slowdown | Growth weakening, inflation sticky |

| Disinflationary Slowdown | Growth weak, inflation falling |

Key Indicators: Chicago Fed National Activity Index (CFNAI), Consumer Price Index (CPI) Year-over-Year, Purchasing Managers' Index (PMI) data

Dimension 2: Liquidity & Policy

What it measures: Central bank stance and money/credit conditions

| State | Characteristics |

|---|---|

| Easing | Real M2/Net Liquidity improving; dollar soft or policy easing |

| Neutral | Mixed signals; no clear direction |

| Tightening | Real M2/Net Liquidity contracting; dollar firm or policy restrictive |

Key Indicators: Real M2 Year-over-Year, Net Liquidity Year-over-Year (Fed - TGA - RRP), US Dollar Index (DXY) trend, policy stance

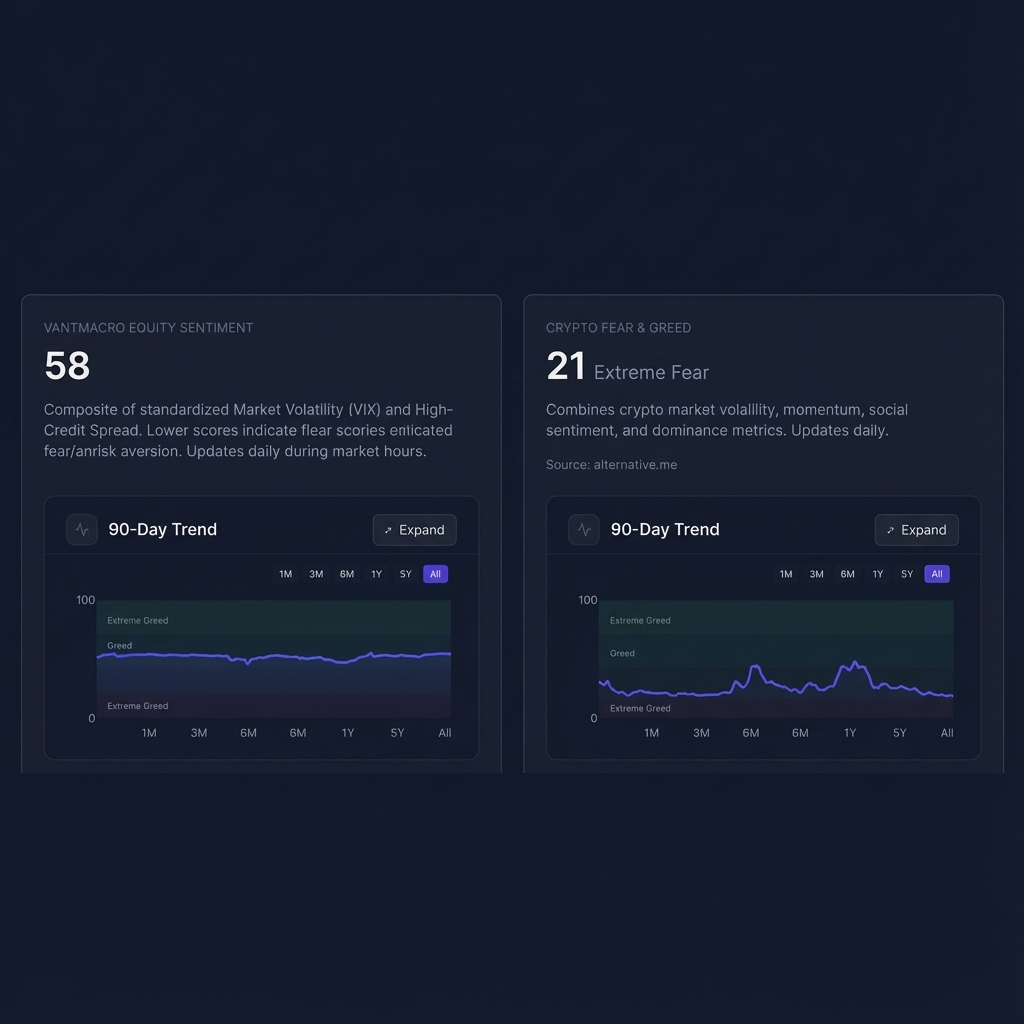

Dimension 3: Market Risk

What it measures: Current market stress and risk appetite

| State | Characteristics |

|---|---|

| Risk-On | Low VIX, tight credit spreads, trending equities |

| Neutral | Mixed signals |

| Risk-Off | High VIX, wide credit spreads, equity weakness |

Key Indicators: Market Volatility (VIX), High-Yield Option-Adjusted Spread (OAS) — credit spreads, equity trend

The 7 Composite Regimes

VantMacro combines the three dimensions into 7 recognizable macro environments:

Empirical Duration & Frequency (2003-2026)

These are empirical statistics from the historical regime timeline (not estimates):

| Regime | Median Duration | Occurrences (Periods) |

|---|---|---|

| Reflationary Expansion | 16 days | 65 |

| Late-Cycle Inflationary Boom | 11 days | 47 |

| Stagflationary Squeeze | 31 days | 33 |

| Disinflationary Slowdown | 8 days | 65 |

| Post-Shock Recovery | 3 days | 129 |

| Crisis/Liquidation | 4 days | 52 |

| Transitional | 3 days | 37 |

Interpretation: This is a high-frequency regime model (days/weeks). It is not intended to label multi-year macro narratives.

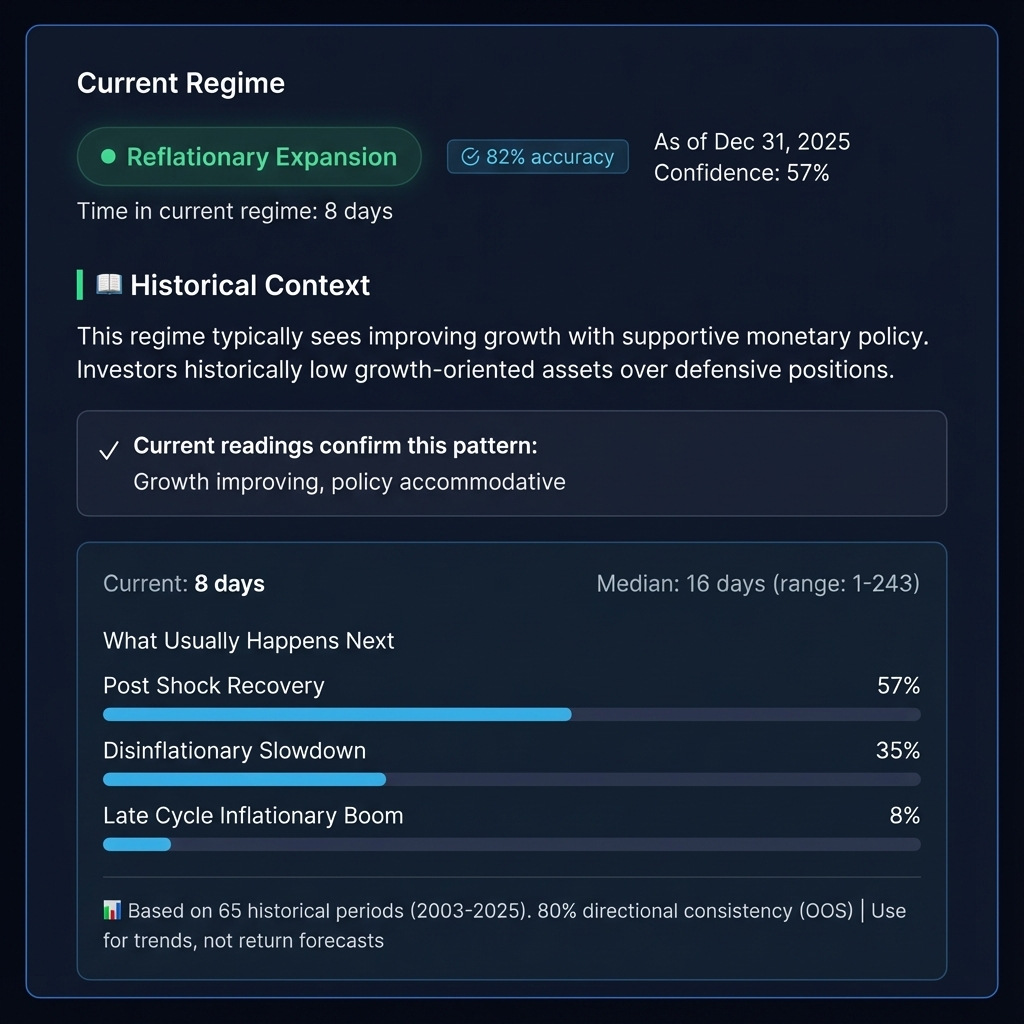

1. Reflationary Expansion

The sweet spot. Growth improving, policy supportive, risk appetite healthy.

- Typical conditions: Early-to-mid cycle expansion, falling inflation, accommodative policy

- Empirical note: Regimes are short-lived in the classifier output; treat this label as “current conditions”, not a forecast

2. Late-Cycle Inflationary Boom

Running hot. Strong growth with rising inflation pressures, policy beginning to tighten.

- Typical conditions: Peak cycle momentum, inflation accelerating, early tightening signals

- Empirical note: This regime often appears in short bursts around inflation surprises and policy repricing

3. Stagflationary Squeeze

The difficult environment. Growth weakening while inflation remains elevated—central banks in a bind.

- Typical conditions: Policy tightening into slowdown, supply shocks, cost-push inflation

- Empirical note: Longer median duration than other regimes, but still typically measured in weeks, not quarters

4. Disinflationary Slowdown

The soft landing attempt. Growth moderating with falling inflation—policy on hold or easing.

- Typical conditions: Late-cycle deceleration, inflation peaking, pre-recession nervousness

- Empirical note: This label is common in the history, frequently surrounding turning points and policy pivots

5. Post-Shock Recovery

The rebound phase. Aggressive policy support following a crisis, early signs of stabilization.

- Typical conditions: Post-crisis liquidity surge, emergency rate cuts, fiscal stimulus

- Verified examples (data-driven):

- 2009-04-01 to 2009-12-31 (64% of days classified as Post‑Shock Recovery)

- 2020-04-01 to 2020-09-30 (61% of days classified as Post‑Shock Recovery)

Note: Short median duration reflects rapid transitions—recovery phases often quickly evolve into Reflationary Expansion.

6. Crisis / Liquidation

Risk-off panic. Major financial stress, deteriorating growth, forced selling across asset classes.

- Typical conditions: Credit markets stressed, VIX elevated (>30), recession or crisis unfolding

- Empirical note: Crisis can appear as multiple short spikes, or as a prolonged episode (the longest in-sample crisis stretch lasts ~8 months)

7. Transitional

Unclear signals. Dimensions giving conflicting readings; market direction uncertain.

- Typical conditions: Data revisions, cross-currents between growth and policy, regional divergences

- Empirical note: Transitional is frequently brief because conflicting signals tend to resolve quickly into another state

How Regimes Transition

Regimes don’t change randomly. From 427 observed transitions (2003–2025), the most likely next regimes are:

| From Regime | Most Likely Next | Second | Third |

|---|---|---|---|

| Crisis/Liquidation | Post‑Shock Recovery (88.5%) | Stagflationary Squeeze (7.7%) | Transitional (3.8%) |

| Disinflationary Slowdown | Post‑Shock Recovery (58.5%) | Reflationary Expansion (32.3%) | Stagflationary Squeeze (7.7%) |

| Late‑Cycle Inflationary Boom | Transitional (48.9%) | Stagflationary Squeeze (38.3%) | Reflationary Expansion (10.6%) |

| Post‑Shock Recovery | Crisis/Liquidation (35.7%) | Reflationary Expansion (28.7%) | Disinflationary Slowdown (27.9%) |

| Reflationary Expansion | Post‑Shock Recovery (56.9%) | Disinflationary Slowdown (35.4%) | Late‑Cycle Inflationary Boom (7.7%) |

| Stagflationary Squeeze | Late‑Cycle Inflationary Boom (50.0%) | Disinflationary Slowdown (18.8%) | Transitional (15.6%) |

| Transitional | Late‑Cycle Inflationary Boom (70.3%) | Post‑Shock Recovery (18.9%) | Stagflationary Squeeze (5.4%) |

Empirical Validation

All of VantMacro's regime classifications are empirically backtested:

- Regime history period: 2003-12-17 to 2025-12-05 (8,025 daily classifications)

- Regime transitions analyzed: 427

- Assets tested: SPX, QQQ, IWM, TLT, LQD, HYG, GLD, DBC

Key Findings

- Equities show the strongest statistical regime dependence — Analysis of Variance (ANOVA) tests show highly significant results (p < .001 for SPX, QQQ, and IWM), meaning the patterns are very unlikely to be random

- Some risk assets also vary by regime — High-yield bonds (HYG) and commodities (DBC) also show significant regime effects (p < .001)

- Bonds and gold show weak regime effects — Long-term Treasuries (TLT), investment-grade bonds (LQD), and gold (GLD) don't show statistically significant regime dependence

- Effect sizes are small but meaningful — Regimes explain about 1% of daily return variation, which is typical—daily returns are dominated by noise. What matters is that these small daily differences are consistent and compound over regime periods (weeks to months). Statistical significance ≠ "easy prediction"; use regimes for context and risk framing

Out-of-Sample Check (Time Split)

Across 5 assets (SPX, QQQ, HYG, GLD, TLT), regime‑level performance patterns show mixed persistence out‑of‑sample:

- Average correlation (in‑sample vs out‑of‑sample regime CAGRs): 0.418

- Average sign consistency: 0.80 (equities strong; long Treasuries weak)

Important caveat: These averages mix equities with TLT, which is misleading. TLT's regime patterns actually reversed out-of-sample (correlation: -0.958), while equities showed strong persistence (SPX: 0.92, QQQ: 0.99). Use regimes for equity context; they don't work for bond allocation in this framework.

Limitations

- Sample size constraints: Some regimes (especially Crisis) have limited occurrences

- Look-ahead bias risk: All backtests are conducted on historical data; real-time classification may differ

- Changing dynamics: Regime relationships may shift over time due to structural changes (e.g., central bank communication, market structure)

How to Use Regime Analysis

As Context, Not Timing

Regime analysis tells you "where are we in the cycle?" not "what should I buy today?"

Good uses:

- Understanding why certain assets are outperforming or underperforming

- Identifying when conditions favor risk-taking vs. defensiveness

- Avoiding fighting the macro trend

- Framing portfolio construction decisions

Poor uses:

- Day-to-day timing decisions

- Ignoring other factors (valuations, positioning, earnings)

- Assuming future regimes will mirror past performance

Dashboard Integration

VantMacro's regime classification appears across the dashboard:

- Overview: Current regime shown with confidence score

- Liquidity: Feeds into the Liquidity & Policy dimension

- Indicators: Feeds into the Real Cycle dimension

- Risk & Sentiment: Feeds into the Market Risk dimension

- History: Compare current conditions to historical regime periods

Common Questions

"Why do some regimes last only a few days?"

Regimes represent distinct macro configurations, not calendar periods. The economy can shift quickly between states, especially during volatile periods. Short durations are common during transitions and crisis episodes.

"Can you predict regime changes?"

Not with precision. VantMacro tracks the indicators that historically precede transitions, but timing is inherently uncertain. The goal is awareness, not prediction.

"Why do Crisis regimes sometimes show positive average returns?"

Because the averages include recovery rallies that occur within the crisis classification period. The negative Sharpe ratios reveal the true picture: high volatility with unreliable outcomes.

"How does this differ from 'risk-on / risk-off'?"

Traditional risk-on/risk-off is a single dimension (market risk). VantMacro's 3-dimensional classification captures more nuance—you can have risk-on market behavior in a deteriorating macro environment, or risk-off behavior during an improving cycle.

Data Sources

- VantMacro dashboard methodology — /dashboard/methodology

- FRED series: CFNAI (

CFNAI) — https://fred.stlouisfed.org/series/CFNAI - FRED series: CPI (

CPIAUCSL) — https://fred.stlouisfed.org/series/CPIAUCSL - FRED series: VIX (

VIXCLS) — https://fred.stlouisfed.org/series/VIXCLS - FRED series: High Yield OAS (

BAMLH0A0HYM2) — https://fred.stlouisfed.org/series/BAMLH0A0HYM2 - FRED series: Fed Total Assets (

WALCL) — https://fred.stlouisfed.org/series/WALCL - FRED series: Treasury General Account (

WDTGAL) — https://fred.stlouisfed.org/series/WDTGAL - FRED series: Overnight Reverse Repo (

RRPONTSYD) — https://fred.stlouisfed.org/series/RRPONTSYD

Methodology

- Classifies regimes from three inputs: Real Cycle (growth/inflation), Liquidity & Policy, and Market Risk (stress/sentiment).

- Empirical summaries referenced here come from a daily historical replay of the classifier (regime periods, transitions, and asset behavior by regime).

- Uses out-of-sample checks (time splits) to validate whether regime-level patterns persist beyond the in-sample window.

Limitations

- Regime labels are model outputs; real-time classifications can differ from backfilled history due to data revisions, publication lags, and model updates.

- Many regimes are short-lived, which limits statistical power and makes annualized performance metrics unstable in small samples.

- Regime analysis provides context and risk framing, not precise timing signals or return forecasts.

Further Reading

- The Complete Guide to Global Liquidity — Deep dive on the Liquidity & Policy dimension

- 427 Regime Changes Analyzed — Detailed empirical research on regime transitions

Track Regimes on VantMacro

See the current regime classification with confidence scores and historical context:

- Real-time regime detection across 3 dimensions

- Empirically-validated performance data

- Transition monitoring and alerts