How to Track Global Liquidity: Step-by-Step Guide

Learn exactly how to track global liquidity using free FRED data or VantMacro. Step-by-step instructions for calculating net liquidity and Real M2.

What You'll Learn

- Download and organize FRED data for liquidity tracking

- Calculate US Net Liquidity from Fed balance sheet data

- Compute Real M2 to measure inflation-adjusted money supply

- Interpret liquidity metrics using empirical thresholds

Many investors hear about "liquidity driving markets" but don't know where to start tracking it themselves. This guide gives you the exact steps to build your own liquidity tracker using free government data—or to skip the manual work entirely with VantMacro.

What you'll learn:

- How to download the right FRED series for liquidity tracking

- How to calculate US Net Liquidity (Fed Assets − TGA − RRP)

- How to compute Real M2 (inflation-adjusted money supply)

- How to interpret your results using empirical thresholds

Time required: 30-45 minutes (DIY) or instant (VantMacro) Difficulty: Beginner Prerequisites: Spreadsheet software (Excel, Google Sheets) or VantMacro account

Prerequisites

Before you begin, make sure you have:

- A FRED account (free at fred.stlouisfed.org)

- Spreadsheet software (Excel, Google Sheets, or similar)

- Basic comfort with formulas and date alignment

If you want to skip the manual process entirely, VantMacro's Liquidity Dashboard calculates everything automatically with daily updates.

Step 1: Download FRED Data

The Federal Reserve Economic Data (FRED) database is your primary source for US liquidity data. You'll need five series:

Required Series

| Series ID | Name | Frequency | Units | Purpose |

|---|---|---|---|---|

WALCL | Fed Total Assets | Weekly | Millions | Fed balance sheet size |

WDTGAL | Treasury General Account | Weekly | Millions | Government cash at the Fed |

RRPONTSYD | Overnight Reverse Repo | Daily | Billions | Money parked at Fed by MMFs |

M2SL | M2 Money Stock | Monthly | Billions | Broad money supply |

CPIAUCSL | Consumer Price Index | Monthly | Index | For inflation adjustment |

How to Download

- Go to fred.stlouisfed.org

- Search for each series ID (e.g., "WALCL")

- Click Download → Excel or CSV

- Select date range (recommend: 2003 to present for full context)

- Repeat for all five series

Pro tip: Use FRED's "Edit Graph" feature to download multiple series at once. Add all series to a single graph, then download as a combined file.

Expected Result

You should have files containing:

- Weekly Fed balance sheet data (WALCL) going back to at least 2003

- Weekly TGA data (WDTGAL)

- Daily RRP data (RRPONTSYD)—you'll need to convert this to weekly

- Monthly M2 and CPI data

Important Caveat

Unit mismatch alert: WALCL and WDTGAL are in millions, but RRPONTSYD is in billions. You must multiply RRP by 1,000 before subtracting, or you'll get wildly wrong results.

Step 2: Calculate Net Liquidity

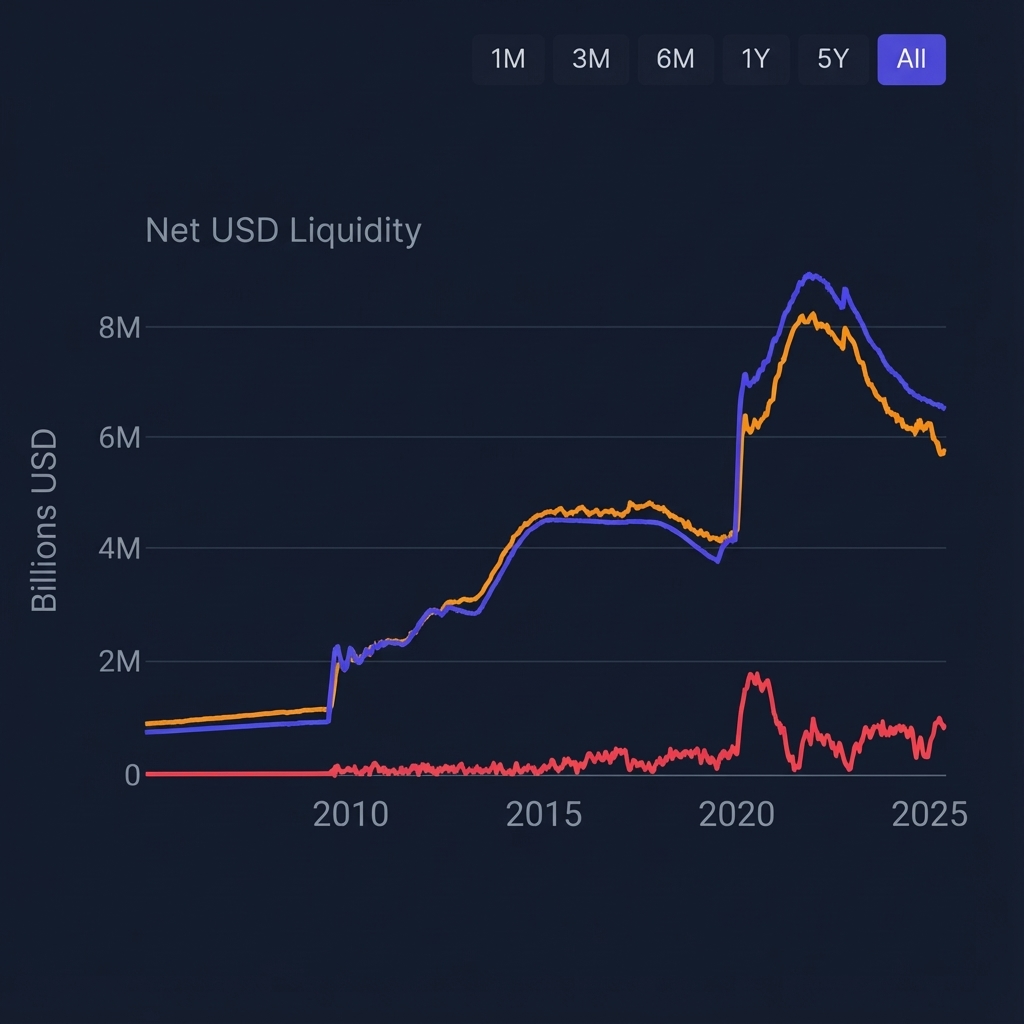

Net Liquidity measures how much of the Fed's balance sheet is actually available to financial markets—not locked up in government accounts.

The Formula

Net Liquidity = WALCL − WDTGAL − (RRPONTSYD × 1000)

All values should be in millions of dollars.

Step-by-Step in a Spreadsheet

-

Create a master date column — Use weekly dates (Wednesdays match FRED's release schedule)

-

Import your data — Paste WALCL and WDTGAL in adjacent columns

-

Handle RRP frequency mismatch:

- RRP is daily; WALCL/TGA are weekly

- Take the Wednesday value (or last available value before Wednesday)

- Multiply by 1,000 to convert billions → millions

-

Calculate Net Liquidity:

= WALCL - WDTGAL - (RRPONTSYD * 1000) -

Calculate Year-over-Year (YoY) change:

= (Current Net Liquidity - Net Liquidity 52 weeks ago) / Net Liquidity 52 weeks ago

Example Calculation

| Date | WALCL (M) | WDTGAL (M) | RRP (B) | RRP (M) | Net Liquidity |

|---|---|---|---|---|---|

| 2024-01-03 | 7,700,000 | 750,000 | 680 | 680,000 | 6,270,000 |

| 2024-01-10 | 7,680,000 | 780,000 | 650 | 650,000 | 6,250,000 |

Expected result: Net Liquidity values in the trillions (displayed as millions in the spreadsheet, so ~6,000,000 = $6 trillion).

Step 3: Calculate Real M2

Real M2 adjusts the money supply for inflation, showing whether purchasing power is actually expanding or contracting.

The Formula

Real M2 = (M2SL / CPIAUCSL) × 100

Then calculate Year-over-Year change:

Real M2 YoY = (Real M2 current - Real M2 12 months ago) / Real M2 12 months ago × 100

Step-by-Step

-

Align dates — Both M2 and CPI are monthly; align them by month

-

Calculate Real M2:

= (M2SL / CPIAUCSL) * 100 -

Calculate YoY growth rate:

= ((Real M2 current / Real M2 12 months ago) - 1) * 100

Why Real M2 Matters

Nominal M2 can increase while Real M2 decreases if inflation is rising faster than the money supply. Real M2 is what matters for purchasing power and liquidity conditions.

Example:

- M2 grows 5% nominally

- Inflation is 7%

- Real M2 is contracting by ~2%

This is a tightening signal even though nominal money supply increased.

Step 4: Interpret Your Results

Raw numbers don't mean much without context. Here's how to interpret your calculations using empirically-derived thresholds from VantMacro's analysis of 427 regime transitions.

Net Liquidity Interpretation

| YoY Change | Signal | Historical Context |

|---|---|---|

| > +10% | Strong expansion | Risk-on conditions typically favored |

| +5% to +10% | Moderate tailwind | Supportive but watch other factors |

| 0% to +5% | Neutral | Liquidity not a major driver either way |

| -5% to 0% | Mild contraction | Headwind building; monitor closely |

| < -5% | Strong tightening | Historical correlation with market stress |

Real M2 Interpretation

| YoY Change | Signal | Historical Context |

|---|---|---|

| > +5% | Expansionary | Supportive for risk assets |

| +2% to +5% | Mildly positive | Normal growth environment |

| 0% to +2% | Neutral to tight | Not providing tailwind |

| < 0% | Contractionary | Historical headwind for risk assets |

Key Point

These thresholds are derived from historical analysis, not arbitrary rules. VantMacro's regime system uses these bands to classify the Liquidity & Policy dimension as Easing, Neutral, or Tightening.

Critical Limitations

Your DIY tracker has important blind spots:

- US-only view — You're missing ECB, BoJ, PBoC, and BoE (the other 55% of global liquidity)

- Manual updates required — FRED data needs regular downloading

- No composite weighting — Professional analysis GDP-weights regional contributions

- Lagged relationship — Liquidity changes lead markets by 3-12 months, but the lag varies

Step 5: Automate with VantMacro

If you want real-time tracking without the spreadsheet maintenance, VantMacro's Liquidity Dashboard does everything above automatically:

What you get:

- US Net Liquidity — Daily calculation with YoY change

- Real M2 — Monthly with YoY growth rate

- Global Liquidity Pulse — GDP-weighted composite of Fed, ECB, BoJ, PBoC, BoE

- S&P 500 Correlation — Rolling correlation analysis

- Regime Integration — Liquidity feeds into the 7-state composite regime classification

Time saved: 30-45 minutes per week of manual updates

Explore the Liquidity Dashboard →

Common Mistakes to Avoid

Mistake 1: Forgetting Unit Conversion

❌ Problem: Subtracting RRP (in billions) directly from WALCL (in millions) ✅ Solution: Always multiply RRP by 1,000 before subtracting

Mistake 2: Using Nominal Instead of Real M2

❌ Problem: Tracking M2 without adjusting for inflation ✅ Solution: Divide M2 by CPI to get purchasing-power-adjusted figures

Mistake 3: Expecting Immediate Market Correlation

❌ Problem: Assuming liquidity changes mean instant market moves ✅ Solution: Liquidity is a medium-term backdrop (months to quarters), not a day-trading signal

Mistake 4: Ignoring Global Liquidity

❌ Problem: Only tracking US data when markets are global ✅ Solution: At minimum, note that your US tracker captures ~45% of the picture. Use VantMacro for the full global view.

Mistake 5: Treating Levels as Signals

❌ Problem: Saying "Net Liquidity is $6 trillion—that's high!" ✅ Solution: Focus on the direction and rate of change (YoY), not absolute levels

Verification Checklist

How to verify your calculations are correct:

-

Net Liquidity sanity check:

- Should be in the range of $5-7 trillion currently (2024-2026)

- Should roughly track Fed balance sheet size minus a few trillion

-

Real M2 sanity check:

- YoY change should be between -5% and +30% in normal conditions

- Should never be exactly the same as nominal M2 YoY

-

Cross-reference with VantMacro:

- Compare your DIY calculations to the dashboard

- Small differences are normal due to data vintage and calculation timing

Summary

You've learned how to track global liquidity yourself. Here's what we covered:

- Download FRED data — Five series: WALCL, WDTGAL, RRPONTSYD, M2SL, CPIAUCSL

- Calculate Net Liquidity — Fed Assets minus TGA minus RRP (watch the units!)

- Calculate Real M2 — M2 divided by CPI, then compute YoY change

- Interpret results — Use empirical thresholds, focus on direction not levels

- Consider automation — VantMacro handles all of this plus global data

Key takeaway: Liquidity tracking is accessible to anyone with a spreadsheet. But the real value comes from consistency, global coverage, and integration with other macro signals—which is what VantMacro provides.

Data Sources

- WALCL — Federal Reserve Total Assets

- WDTGAL — Treasury General Account

- RRPONTSYD — Overnight Reverse Repo

- M2SL — M2 Money Stock

- CPIAUCSL — Consumer Price Index

Methodology

- Calculates US Net Liquidity as

WALCL - WDTGAL - (RRPONTSYD × 1000)with unit normalization to millions of dollars. - Real M2 computed as

(M2SL / CPIAUCSL) × 100with YoY percentage change for trend analysis. - Interpretation thresholds derived from VantMacro's analysis of 427 historical regime transitions (2003-2025).

Limitations

- This guide covers US liquidity only; global tracking requires ECB, BoJ, PBoC, and BoE data with GDP weighting.

- FRED data has publication lags (typically 1-7 days depending on series).

- Liquidity-market correlations are unstable across regimes and do not imply causation.

- Not investment advice; use liquidity metrics as context, not timing signals.

Further Reading

- The Complete Guide to Global Liquidity — Understand what global liquidity is and why it matters

- What is Net Liquidity? — Deep dive on the Fed balance sheet formula

- What is Real M2? — Understanding inflation-adjusted money supply

Track Liquidity on VantMacro

Skip the spreadsheets and get real-time liquidity tracking:

- Daily Net Liquidity and Real M2 with YoY changes

- Global Liquidity Pulse across 5 central banks

- Correlation analysis with S&P 500

- Integration with regime classification